Why is the IoT important for the future?

IoT stands for “Internet of Things.” It consists of gadgets that connect to the internet and exchange data with one another. In addition to laptops,

What Are The Most Interesting Blockchain Applications In Fintech?

To stay competitive, banks may now provide fintech-related services to up-and-coming fintech companies. One technology that promises to revolutionize the internet is Blockchain. Companies in the financial technology (fintech), healthcare (Medtech), insurance, cyber security, and software as a service (SaaS) sectors are all using Blockchain.

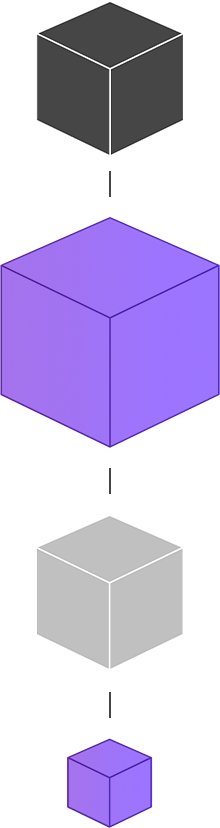

First of all you have to begin with understanding what blockchain is and why it matters.

Many banks have seen operations for a long time as just the back end of a customer-facing process. Today, that point of view is not just old. It gets in the way of customer-centered innovation. So, the bank’s functional architecture must have the scalability to handle these.

Blockchain in banking introduces a new lending system that can quickly, cheaply, and safely lend money to individuals. To apply for a loan, clients benefit from a decentralized database that stores their payment history.

The word “fintech” refers to the emerging technological framework that streamlines and enhances the provision of monetary services. However, banks are financial entities authorized to take client deposits and lend money.

IoT stands for “Internet of Things.” It consists of gadgets that connect to the internet and exchange data with one another. In addition to laptops,

Recent advancements in artificial intelligence and security intelligence indicate that the technology has the potential to become an invaluable asset for companies in a wide

Since the turn of the century, many companies’ security departments have made great steps toward becoming fully integrated into the overall strategy and development of

Thanks to advancements in fintech and the Blockchain, individuals now have the freedom to share just the information they deem necessary with the people they choose. FinTech uses tools like Blockchain to revamp traditional banking practices. Blockchain-based fintech enables instantaneous money transfers, state-of-the-art security, and traceable financial transactions.

By allowing for secure and efficient financial transactions, Blockchain has the potential to revolutionize everyday financial procedures. It is expected that semi-manual data reconciliation would be unnecessary if Blockchain is fully implemented into banks’ day-to-day operations. Blockchains may be thought of as encrypted and immutable database systems.

Follow us on LinkedIn Follow Sowedane

Follow Sowedane on Twitter @Sowedane

Visit the Sowedane blog Follow Sowedane